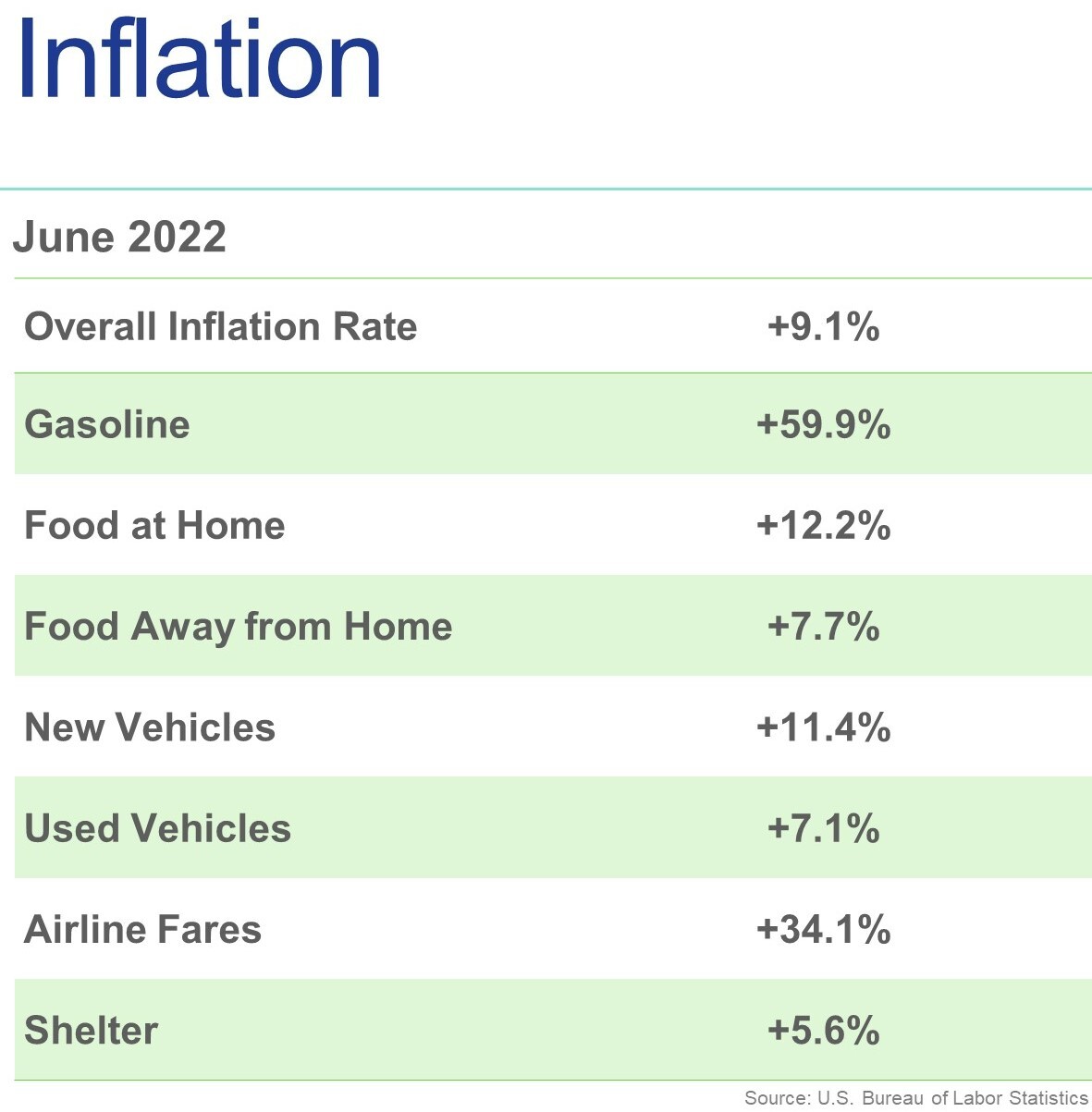

Prices were up in June for most categories of goods and services. However, the biggest increase was fuel, with gas prices up 59.9% compared to a year ago. This has a huge impact on individual households, as their price at the pump continues to escalate. But rising gas prices also impact businesses by increasing transportation costs, and then these higher costs get passed on to consumers in the form of higher prices. The costs of food—whether eating at home or dining out—also increased again in June. And like gas prices, continued rising prices for food have a major impact on families’ budgets.

Some people have been referring to this summer as the summer of “revenge travel” and that surge in demand for vacationing has driven up travel costs. Airline fares, for example, are up 34.1% compared to last year at this time.

What Will the Fed Do?

Many economists had been predicting (hoping?) that inflation had peaked in May. With the new June numbers, it is likely that when the Federal Reserve meets again later this month, they will be talking about another aggressive rate hike. If the Fed announces a three-quarter percentage point rate hike, it will be the second in a row and would be a very rare move by the Fed. But these rate increases are the primary tool the Federal Reserve has to try to target persistently high inflation.

What Does This Mean for the Housing Market?

The housing market had already begun to cool considerably as a result of rising mortgage rates and growing affordability challenges. A Federal Reserve rate increase could push mortgage rates even higher than they have been. However, there are other economic factors that drive mortgage rates, including global economic conditions and overall demand in the housing market.

It is likely that mortgage rates will bump around over the next few months, rather than track a steady upward trend. But either way, the rising cost of borrowing, coupled with the impacts high inflation is having on household budgets, means that we should expect buyer demand to continue to cool throughout the summer. Expect fewer home sales, a slight increase in inventory in most local markets, and prices that will continue to rise, though at a slower pace than we have seen over the past two years.

To stay informed about housing market conditions, be sure to make use of Bright’s housing market reports and get a preview of future buyer activity by tracking the Bright MLS T3 Home Demand Index for the Philadelphia, Baltimore, and Washington DC regions.

July 13, 2022

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link